Generic drugs are the silent backbone of global healthcare

By 2030, nearly 9 out of 10 prescriptions written around the world will be for generic medicines. But the landscape is changing fast. What used to be a simple game of copying old patents and cutting prices is now a high-stakes race involving complex biology, geopolitical supply chains, and billion-dollar investments. The days when a generic drug was just a cheaper version of a brand-name pill are over. Today, it’s about biosimilars, API shortages, and governments forcing local production.

Why generics still dominate - and why they’re losing ground

In 2024, generic drugs made up 57.6% of all pharmaceutical sales globally. That’s more than half the market. But here’s the twist: even though they fill 90% of prescriptions in the U.S., they only account for 23% of total spending. Why? Because the most expensive drugs - biologics, cancer treatments, GLP-1 weight-loss drugs - aren’t generic yet. And they’re growing fast.

As of 2025, over $70 billion in branded drug revenue is losing patent protection each year. That should mean a boom for generics. But the reality is messier. The easy targets - small-molecule drugs like statins or metformin - are already saturated. Profit margins have dropped from 18% in 2020 to just 12% today. Manufacturers can’t keep cutting prices and stay in business. So they’re shifting focus.

The biosimilar revolution is just getting started

Biologics - complex drugs made from living cells - used to be untouchable. Too expensive to copy. Too hard to replicate. But that’s changing. Biosimilars, the generic versions of biologics, are now the fastest-growing part of the generic market. They’re growing at 12.3% a year, compared to 5-6% for traditional generics.

Why? Because drugs like Humira, Enbrel, and Rituxan are losing patents. These are billion-dollar drugs. A biosimilar might cost 15-30% less than the original - not 80% like a regular generic - but that’s still a massive savings for health systems. The catch? Making a biosimilar isn’t like mixing pills. It takes 10 to 20 times more steps than making a small-molecule drug. Development costs hit $100-250 million. Only big players can afford it.

Companies that used to make aspirin generics are now being squeezed out. The winners are firms like Sandoz, Amgen, and Indian giants like Biocon and Dr. Reddy’s that invested early in biotech. The market for biosimilars will be worth over $100 billion by 2030. But it won’t be crowded. It’ll be dominated by a handful of players with deep pockets and advanced labs.

Asia is the factory of the world - and it’s getting more powerful

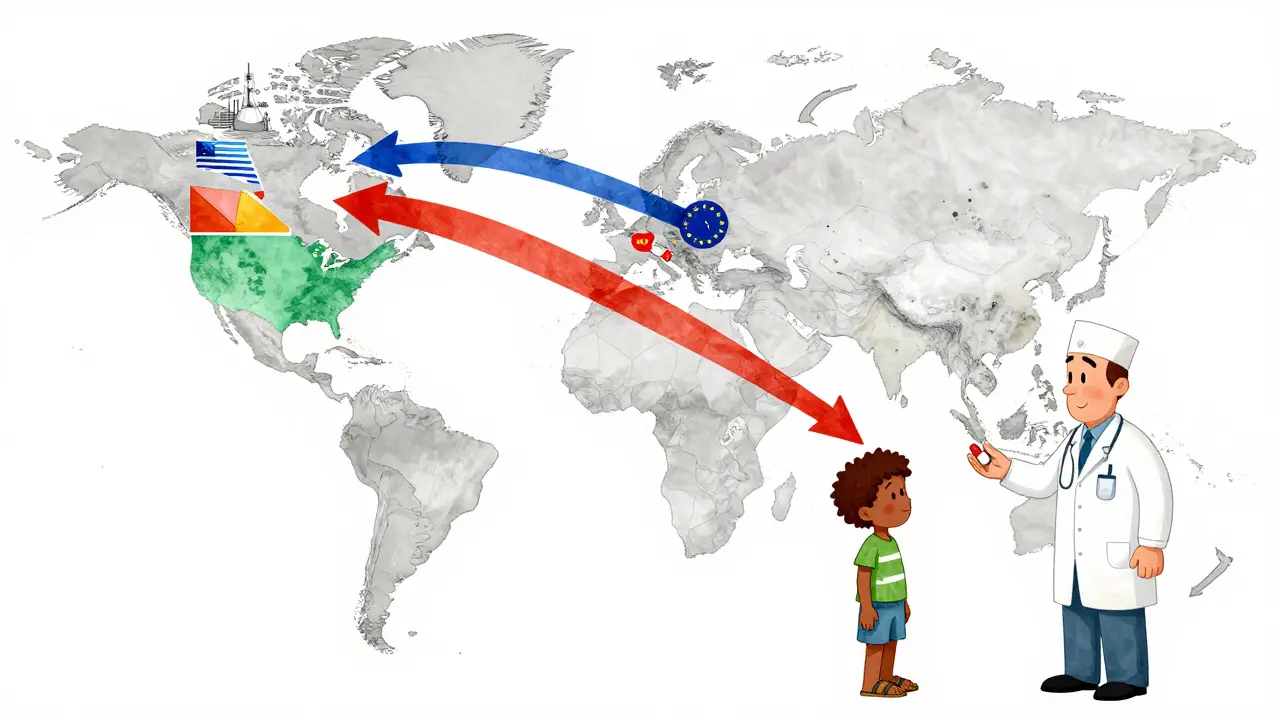

India and China together control about 35% of global generic manufacturing. India alone makes over 60,000 generic medicines and supplies 20% of the world’s volume by quantity. China produces 40% of the world’s active pharmaceutical ingredients (APIs) - the raw chemicals that make drugs work.

But this isn’t just about scale anymore. It’s about control. In 2024, China supplied 65% of all APIs used in global generics. That’s a massive risk. If a single factory in Shanghai shuts down due to regulations, weather, or politics, hospitals in Europe or the U.S. could face shortages.

That’s why countries are pushing back. The U.S. and EU are funding domestic API production. India’s government dropped $1.34 billion in 2024 into its Production Linked Incentive scheme to boost local manufacturing. Egypt wants 50% of its essential medicines made at home by 2025. Saudi Arabia’s Vision 2030 includes building its own generic drug industry. The goal? Less dependence. More resilience.

Emerging markets are where the real growth is

North America and Western Europe? Their generic markets are barely growing - 2% to 5% a year. Prices are locked in. Regulators demand more testing. Profit margins are thin.

But in places like India, Brazil, Turkey, and Nigeria? Growth is hitting 9.7% a year. Why? Because these countries are expanding healthcare access. More people have insurance now. More clinics are opening. And they need affordable drugs.

By 2025, these so-called “pharmerging” markets will add $140 billion in new drug spending. That’s more than the entire pharmaceutical market of Canada or Australia. And generics are the only option for most patients there. A diabetes pill that costs $100 in the U.S. might cost $2 in Nigeria. That’s not just a price difference - it’s a life-or-death gap.

Companies that ignore these markets are walking away from their next decade of growth. The future isn’t in cutting prices in Germany. It’s in building distribution networks in Lagos, training pharmacists in Jakarta, and working with local regulators in Bogotá.

Quality is the invisible crisis

Here’s something most people don’t realize: in 2023, the U.S. FDA issued 187 warning letters to foreign generic drug manufacturers. Forty percent of those were for quality issues - dirty factories, falsified data, poor storage. One contaminated API batch can lead to recalls across continents.

It’s not just about corruption. It’s about complexity. Making a generic drug isn’t easy. The molecule has to match the original exactly. The absorption rate, the excipients, the coating - all of it matters. And when you’re producing millions of doses a day in a factory with outdated equipment, mistakes happen.

Regulators are catching up. The International Council for Harmonisation (ICH) added 15 new countries to its guidelines in 2024. That means more factories will have to meet the same standards. It’s expensive. It’s slow. But it’s necessary. Without trust in quality, the entire system collapses.

What’s next? Three big shifts

- Vertical integration: Big generic companies are buying API makers, logistics firms, and even pharmacies. Why? To control the whole chain - from chemical to shelf. No middlemen. Lower costs. Fewer delays.

- Specialization over scale: Instead of making 100 cheap pills, the smart players are focusing on 5-10 high-complexity generics - like injectables, inhalers, or long-acting formulations. These are harder to copy, so they’re less competitive and more profitable.

- Government as partner: No longer just a buyer, governments are becoming investors. India’s PLI scheme, Brazil’s public procurement rules, and Saudi Arabia’s local content mandates are all forcing manufacturers to play by new rules. The winners will be those who align with national health goals - not just profit targets.

Will generics still matter in 2030?

Yes - but differently. The share of generic drugs in total pharmaceutical spending will drop from 57.6% in 2024 to around 53% by 2030. That sounds like a decline. But here’s the real story: the total market is growing to $1.7 trillion. So even at 53%, generics will be worth over $900 billion. That’s more than the entire global generic market was in 2023.

The future belongs to manufacturers who understand this: generics aren’t just cheap copies anymore. They’re sophisticated, regulated, strategically vital products. They’re the only way billions of people get access to life-saving medicine. The companies that survive won’t be the ones with the lowest prices. They’ll be the ones with the strongest supply chains, the cleanest factories, and the clearest purpose.

Who wins? Who loses?

Small manufacturers without biotech capabilities? They’ll fade out. Companies stuck in low-margin, high-volume production? They’ll be bought or bankrupted. The winners will be those who invest in biosimilars, build local partnerships in emerging markets, and treat quality as non-negotiable.

It’s no longer about who can make the cheapest pill. It’s about who can deliver the safest, most reliable, most accessible medicine - at scale, on time, every time.